Moving beyond plain vanilla e-commerce in China

This article was first published on Enterprise Singapore on 15 April 2021

Growing your e-commerce market share in Asia’s largest economy calls for new data-driven strategies.

Growing e-commerce market share calls for new data-driven strategies

The global retail industry is evolving rapidly due to digitalisation and changing consumer needs sparked by the COVID-19 pandemic.

While e-commerce has been growing at a steady clip since the mid-1990s, brick and mortar retailers reeling from lockdowns have accelerated online strategies while shuttering stores.

What’s interesting is that the shift caused by the pandemic isn’t purely online. New strategies to capture market share and enhance customer experience have emerged, according to industry experts at the Singapore Week of Innovation and TeCHnology (SWITCH) 2020.

Nowhere is this more evident than in China, the world’s top e-commerce market. In 2019, e-commerce sales in China topped US$1.9 trillion (~S$2.5 trillion), more than three times that of the US, which was at second place with US$586.9 billion (~S$774.6 billion).1

Data is king, distribution is queen

Not only do insights from data analysis help you understand your customers, they empower you to deliver a personalised experience for them based on their consumption habits.

In China, retailers are increasingly turning to data and analytics to develop business models that merge offline and online strategies to better target customers and deliver a seamless and enjoyable shopping experience.

While China is the world’s largest e-commerce market, it’s also forecast to be the world’s largest retail market in 2021, with spending of US$5.8 trillion (~S$7.7 trillion), said Ms Emmy Teo, Chief Product Officer of smart retailer 8XP, a speaker at SWITCH 2020.

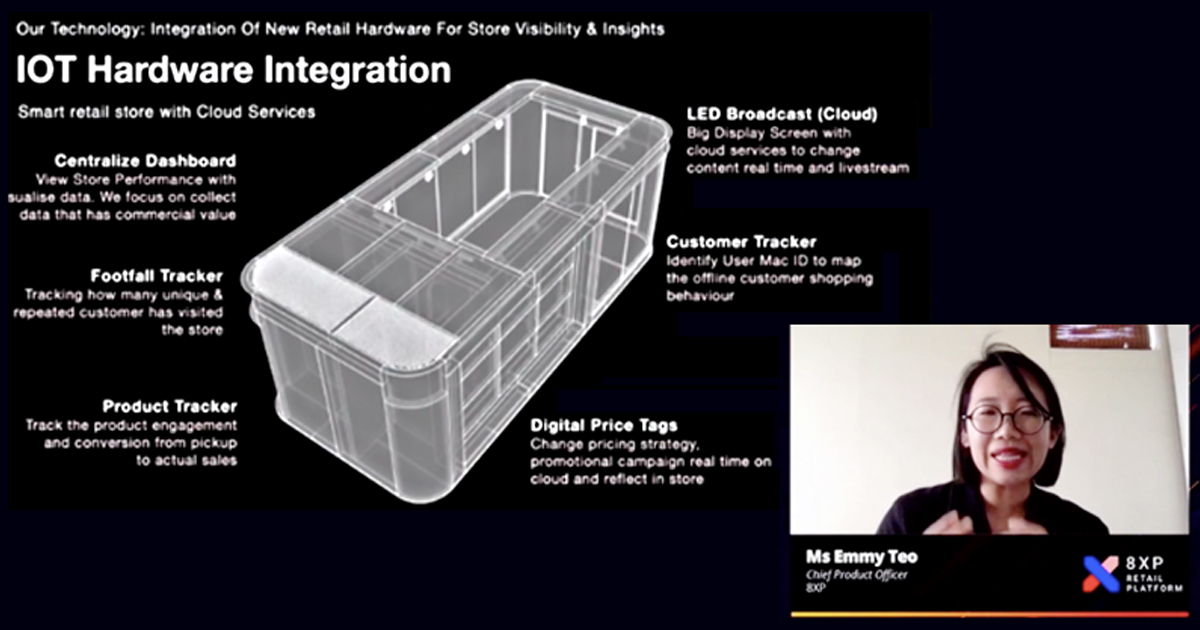

8XP is a Singapore startup based in Shanghai. It offers a retail platform that helps companies in China grow their business by integrating their online and offline stores.

“Unicorns” in China that have an established online presence are increasingly adding physical stores to grow their business, she said. But these are not your run-of-the-mill physical stores.

They can be set up in as quickly as eight hours and integrated with the Internet of Things (IoT) hardware to help retailers capture data about their customers, track footfall, change pricing strategy on the fly with digital price tags, as well as engage customers with livestream content while they are browsing.

Ms Teo noted that when brands opt for an omnichannel strategy, they are not simply tapping technology to enhance customer experience. Rather, technology is also integral in helping businesses make strategic commercial decisions based on data collected on their customers.

For IKEA China, the pandemic has accelerated its push towards digitalisation. When lockdowns prevented customers from visiting their stores, the digital team focused on building a robust data analytics platform to connect with customers and better understand what they want, said Ms Lucy Luo, Data Engineer at IKEA China’s Digital Hub.

Today, the company holds some 10 billion records that help to guide key business decisions and deliver an enjoyable experience for its customers, she added.

The rise of the Consumer-to-Manufacturer (C2M) model

Driven by the proliferation of big data, companies such as Pinduoduo Inc connect consumers directly with suppliers, or manufacturers to buy anything from farm produce to clothing and electronics at low prices. Because of the direct connection established between buyers and sellers in the C2M model, suppliers have direct knowledge of what customers want.

The C2M model cuts out all middlemen, which makes it possible for customers to enjoy personalised goods at low prices. The model, which focuses on customer centricity, also reduces pressure on manufacturers to stock inventory.

Shoppertainment rocks

Besides C2M, another hot trend in China’s retail space is livestreaming, which not only makes shopping entertaining but also helps customers make purchase decisions with the help of online communities.

For example, Pinduoduo incentivises its users to grab friends and family to join the platform so they can buy in groups to enjoy savings. Livestreaming is an integral part of its strategy. Communities livestream to provide feedback on products for fellow users, adding to the fun and engagement that keeps customers coming back.

The average consumer in China spends more than seven hours a day on the mobile internet, up by a fifth in the aftermath of the COVID-19 pandemic. Some two-thirds of these seven hours is spent on social or content apps, as consumers check social media accounts for information from friends and influencers for advice before buying, according a recent McKinsey study.2

As of September 2020, Pinduoduo has attracted 721 million active users on its platform, said Ms Lim Xin Yi, Pinduoduo’s Executive Director for Sustainability and Agriculture Impact.

“We started the livestreaming feature in January 2020 and it was fortuitous, due to the COVID-19 lockdown,” she said. “Livestreaming encourages discovery, it reassures buyers. It’s almost a personalised guide for your buying journey.”

Unlike most retailers that run sales campaigns such as Singles Day, Pinduoduo focuses on everyday savings for consumers.

Ms Lim said, “We work at consistently giving merchants a large base, so they can parlay the savings to customers.

The C2M model in China has also benefited the agricultural industry. And it has also been the COVID-19 pandemic that has fuelled interest in the Pinduoduo platform because of heightened consumer need for fresh produce when cities were locked down, she shared.

Technology savvy farmers who tapped the Pinduoduo platform to sell fresh produce directly to consumers soon roped in other farmers, growing the community of farmers over time and increasing sales and logistical efficiency. With more farmers onboarding the platform, Ms Lim also saw this movement as one that has helped to nurture human capital in rural areas, especially at a time when China’s farming population is ageing.

The future of retail

Experts at SWITCH 2020 envision innovative digital solutions such as artificial intelligence (AI) to continue to play a key role in transforming customer experience. While many physical stores have shuttered during the pandemic, pop-ups that tap technology such as IoT and artificial intelligence are expected to become increasingly popular with retailers.

The concept of space in retail could evolve as well, with retailers possibly moving away from renting large spaces to simply taking up a small space within, say, a café, as a base to reach consumers, said 8XP’s Ms Teo. No matter the size of the retail space, what’s key in driving retail growth is having a data-driven mindset to guide business decisions – one that leverages technology to engage users and gathering valuable insights such as consumer preferences and habits.

Are you a retailer looking to grow your business in China? Learn more about how Enterprise Singapore can help you tap new opportunities in the world’s fastest growing e-commerce market.

1 “Global ecommerce 2019: Ecommerce Continues Strong Gains Amid Global Economic Uncertainty”, Emarketer, 27 June 2019

2 “Understanding Chinese Consumers: Growth Engine of the World, China consumer report 2021”, McKinsey & Company, 9 November 2020