Q and A With Timothy Draper Founding Partner Of Draper Associates

As a renowned global venture capital investor and founder of Draper Associates, Draper Fisher Jurvetson (DFJ) and the Draper Venture Network, a global network of venture capital funds, Timothy (Tim) Draper had helped innumerable entrepreneurs drive their visions. Some of the most prominent investments that Draper had made over the years includes, but not limited to, Baidu, Hotmail, Skype, Tesla, SpaceX, Twitter, Coinbase and Twitch.

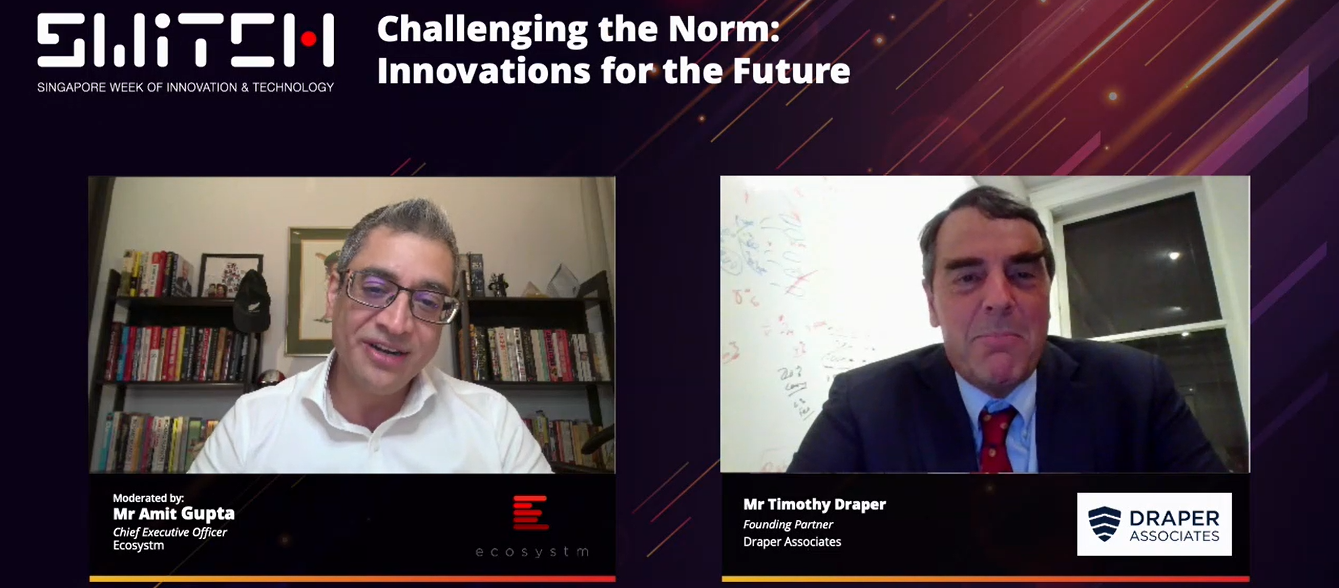

At the Singapore Week of Innovation and TeCHnology (SWITCH) 2020, we are honoured to have Tim Draper on board where he shared his vision on the future of innovation and what he looks for in aspiring entrepreneurs.

A strong advocator of globalisation, Tim Draper believed that entrepreneurs should do more than just making money—they should be driving fundamental changes to solve the world’s problems with simple and unique solutions.

During his panel at SWTICH, Tim Draper revealed the key elements he looks for in an entrepreneur.

“When I meet entrepreneurs, what I’m really looking for is: Is this your passion? Is this your love? Is this really what you want to spend your life doing? And is it a big enough thing for you to make happen? And is that a big enough deal?”

In his closing remarks, he asserted that it is going to be these entrepreneurs that will take us outside of COVID-19, that wll make us more global and interconnected—and this will allow us to achieve the extraordinaries in our generation.

We catch up with Tim Draper on a few more burning questions we have on all things technology and innovation

On Innovation and Transformation

Q: Similar to email 30 years ago, or SMS 20 years ago…. what are some of the things we don’t know if we need yet, but may not be able to live without in 5-10 years’ time?

A: Jet packs, crypto wallets, identity proof, VR communications.

Q: What do you think can be done on a national level to ensure meaningful innovations in the next decade?

A: Light touch regulations are important for any government to survive/compete in the coming decade.

Q: While impending innovations may hold promising changes in the future, they also might not. What scepticisms about the effects of these innovations do you have?

A: That is the name of our business. We have to be willing to fail if we want to win big.

On Investing in Startups

Q: Trust and vision for future are very intangible, any tangible criteria for you to decide whether to invest?

A: I tend to invest when the leadership of a country is making a change toward freedom and trust. The rate of change is almost more interesting than the status quo.

Q: If you meet 8 entrepreneurs every day, what are some principles for discernment that you apply when deciding who to invest in?

A: I look for the right reasons. Making money is not enough. Entrepreneurs need to make fundamental change. What I look for is also uniqueness and simplicity of the solutions.

On Cryptocurrency

Q: Will financial risks increase under a bitcoin system of exchange since it implies that central banks have drastically reduced the scope to regulate (bitcoin and by extension, monetary policy)?

A: I believe there will be far less financial risk. A Bitcoin system is monitored by the network, and not from a political source that can print fiat at will without oversight (e.g. the many trillion-dollar COVID bailout) and dilute the owners.

Q: What is the role of private crypto in the world of Central Bank Digital Currency? Also, how do they manage financial crimes, terrorism funding and anti-money laundering?

A: It turns out that crypto on the blockchain keeps perfect records, so it is more likely to catch criminals than fiat cash, which can’t be easily traced.